Is your shareholders agreement fit for purpose?

Rating system:

Reading time (1-10 minutes): 2

Sophistication level (1 (idiot) – 10 (expert)): 3

Entertainment value (1 (turgid) – 10 (side-splitting)): 4

This is the second to be released of a series of Guides about shareholder arrangements.

My first Guide explained the default position where you don’t have a shareholders agreement or tailored Articles of Association for your company.

This Guide is a very short introduction as to why you might need a shareholders agreement in different shareholder scenarios which can arise during the course of a company’s lifecycle.

In future Guides I will explore in more detail the kinds of issues which need to be considered in different shareholder scenarios; starting with my next Guide which will go into quite a lot of detail about shareholder arrangements between different sorts of founders.

A shareholders agreement can save you, the other shareholders, and the company itself, a lot of difficulty in the future. For example, it can:

- provide clarity as to the shared objectives of the shareholders for the company and as to the roles of all parties, and as to how they and the company should deal with different possible scenarios

- help prevent fallouts and avoid disputes which can be damaging and costly for the shareholders and for the company itself

- clarify and help to protect each shareholder’s interests and the value of their investments

- help to protect the value of the company

When it is prepared with a view to having additional shareholders in the future, such as investors and key employees, it can show them that you are serious and professional about the governance and management of your business, which should make it look like an attractive investment for them.

Getting professional advice on how to protect your interests, and then getting professional help in putting together an appropriate shareholders agreement (and possibly tailored Articles of Association) can be vital.

One size doesn’t fit all

The ownership structure of companies can be in all sorts of shapes and sizes. It can involve any number of shareholders, all of whom might have different interests. Often companies go through phases – for example, starting as a one-owner start-up; then bringing in other early ‘founders’; then bringing in early stage angel or seed investment; then bringing in key employees or consultants to incentivize them; and then bringing in later stage investment.

The kinds of issues you might want to address in a shareholders agreement depend on the breakdown in your particular case. Each shareholder will have their own interests to protect, and a bit of negotiation is needed where different shareholders have potentially conflicting interests. There is no ‘one size fits all’, and each case needs to be thought about carefully based on the particular facts, with the support of an onhand experienced specialist corporate lawyer of course. There are certain basic issues which generally come up in every case. For example, a shareholders agreement between founders of a company needs to address:

- How many shares should be owned by each founder, and why.

- Control and management issues.

- Ongoing commitments and contributions.

- Job security.

- Exit provisions.

- Information rights.

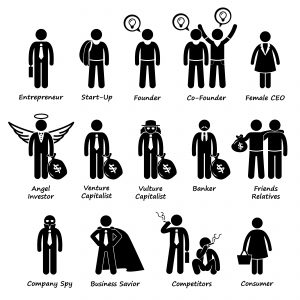

Here is a breakdown of some of the different types of participants you might find in a private company.

- Controlling founder (broadly owning over 50% of the shares)

- Minority shareholder founders working with a controlling founder

- Minority shareholder founders where none is a controlling founder

- 50:50 founders (the ‘deadlock’ company)

- Key employees or consultants brought in to incentivize them.

- Early stage investors (eg seed or angel investors)

- More sophisticated later stage investors (eg VCs)

- Joint venture companies where two existing businesses pool resources into a joint venture business.

What next? Contact me for a complimentary Shareholder Arrangements’ consultation

If you are thinking of entering into any shareholder arrangements with business partners or investors or are having any issues or difficulties with existing arrangements please feel free to email me at andrew.james@onhandcounsel.co.uk to arrange a complimentary ‘Shareholder arrangements’ consultation where I can help you to identify what might be involved and how I can help. This will help you to avoid some of the pitfalls to which you might otherwise be exposed, and give you the peace of mind of knowing that you have an approachable competent corporate lawyer ONHAND who can provide you with experienced, effective and cost-effective advice and assistance.

If you are a director or shareholder of a company and want more information on how to deal with shareholders and director relationships so you can protect the value of your business and your role in it, together with your business and exit objectives, then please contact me.

Would you like to receive further Guides and other published articles containing legal updates and tips? If so, click below…

Sign up for more Guides and legal updates